Fixed Deposit Investment

- Fixed Deposit Investment Calculator

- Fixed Deposit Account Investment

- Fixed Deposit Investments In South Africa

- Fixed Deposit Investment At A Financial Institution

We all want the highest return from an investment but we often fail to do so because of lack of expertise. We are going to look at some of the ways to get the highest return on investment when investing in a fixed deposit.

FD rates today are on a downward spree because of economic uncertainty, therefore making it imperative for you to find out smart ways of investing in fixed deposits in order to maximise your returns from the investment.

Even though FD is one of the risk-free & Smart investments, there are various things that you should keep in mind before investing in a fixed deposit to get the highest returns.

Before you decide to invest, you should use tools like the online FD calculator to calculate your returns in advance. Also, look out for higher FD rates, in comparison to post office fixed deposit interest rate.

Smart Ways to Invest in Fixed Deposit:

Fixed Deposit Investment Calculator

Put as little as R1 000 to work for you, for a period of one month to 17 months and enjoy the benefits and returns of a fixed interest rate. Fixed Deposit investment account Set your investment period, make a single deposit, and see your money grow at a fixed rate. R 1 000 Opening deposit At Maturity Access to Funds 6.40% earn interest.

Online Fixed Deposit Calculator:

You should use anonline FD calculator to calculate the amount of interest you are going to get at the end of maturity. You can also get information on the FD rates if you investtoday. OnlineFD calculators can also help determine the terms on which you want to invest.

Fixed Deposit Account Investment

It also helps you choose the type of fixed deposit. On the website of Bajaj Finance, you can access one of the most easy-to-use online FD calculators which have all the features that you need to calculate your return on investment.

Online Application Process

The smart way of investing in fixed deposit is avoiding queues and investing online. You can get the complete investment experience while sitting at your home. You can apply through an online portal and then a company representative will get back to you. And you can even pay online for your fixed deposit. You should use this online fixed deposit as it is very convenient.

Multi Deposit Facility:

You can avail a multi deposit facility to save yourself from the loss of interest when you break your fixed deposit prematurity. You can open multiple fixed deposit accounts when you invest in a fixed deposit through a single cheque. And if you need money due to an emergency in an unfortunate circumstance you don’t have to break all your FDs and incur losses in the form of reduced interest rates.

The reason for this is, each fixed deposit is considered as a separate FD so you can easily invest in multiple fixed deposit accounts and you can also choose different terms for these fixed deposit accounts.

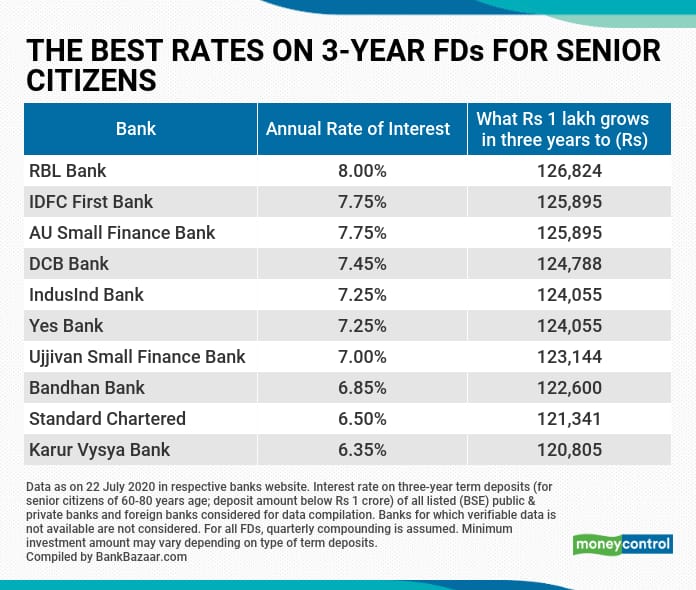

Choose a Scheme with Higher Rate of Interest

There are various schemes that are available in the market for you to choose from. Customised schemes give you a higher rate of interest. For example, Senior Citizen Fixed Deposit by Bajaj Finance has one of the highest rates in the industry, i.e. 7.85% for 5 years FD, which is 0.25% higher than regular FD rates. It is also much higher than the post office fixed deposit interest rate which is currently 6.7% for a 5-year deposit.

There are many smart ways to invest in a fixed deposit through which you can avail of the highest FD rates today. You should always keep an eye on the latest schemes that are initiated by the government and companies. You should always use an online FD calculator to calculate the amount of interest that you will get at the end of maturity.

You should avail facilities like multi deposit facility to have convenience while investing. Schemes that are meant for senior citizens such as Bajaj Finance Senior Citizen Fixed Deposit have a higher rate of interest.

Fixed Deposit Investments In South Africa

- High interest rates

- Insured by the NDIC

- Regulated by the CBN

- Simple, online process

Fixed Deposit Investment At A Financial Institution

How it works

Start a Fixed Deposit

Choose how much you want to invest and for how long

Share some details

Share some information about yourself

Start Earning

Fund your fixed deposit and start earning more on your money